FEAR!

If you asked a dozen people on the street from different backgrounds if they were worried about anything, or what they may fear, you would probably get twelve different answers. To be sure, if you asked twelve informed long-term investors what they fear they would give a few different answers, but surely not twelve being all over the map. They would surely focus on a few major global and local issues, and two at the top of the list would be global thermonuclear war with North Korea, and the coming debt ceiling deadline.

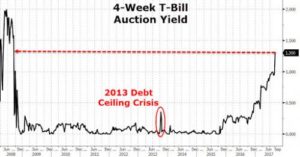

Without even mentioning the cost of the hurricane devastation above, costs of the government are always increasing, but now they will spike. Harvey and the coming Irma will add a huge amount of debt to the already gargantuan pile of US debt notes. Some in the Congress want to add relief spending to the upcoming debt ceiling deadline, but several are not having it. There was a recent 4-week T-Bill offering by the US Treasury and as you can see below, the yields spiked, which tells us that the pros in the bond pits are buying the fiction being reported that it will all go through without a hitch.

Just this past weekend, Kim Jong-un, the leader of North Korea, tested another nuclear weapon. Moreover, it was ten times strong than the last test, according to Richter scale data. If that wasn’t enough, the saber rattler may be about to launch another I.C.B.M. this coming weekend. Yes sir, that currently is putting fear in the market, which is helping gold and silver in a big way. If you remember, we said some time ago that if gold closed above $1,300/oz that it had a good chance of going much higher, which it did.

Will the fear in the market drive it even higher?