8 Days Make a Record in Gold

The last few weeks recorded a special period of time for gold. Last Monday marked the 8th consecutive bullish close in the futures (GC) market, which set a record that was widely reported across the internet. The $1,300.00 per ounce price had been a major resistance level for gold; however, the recent record-setting rally smashed through it and traded as high as $1,327.30 on January 4th.

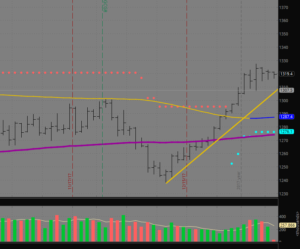

The following chart shows the strength of the rally, which may just be starting, and would therefore be a good time to invest in gold.

Safe Asset

Gold was not the only asset in rally mode over the last few weeks. We all know that global stocks seem to set new all-time high records on a regular basis. This extreme move, however, has led a lot of people to wonder if it has gotten out of control. When will it reverse; they wonder.

In a recent interview former Reagan White House Budget Director, David Stockman, addresses the safe asset issue and more.

“I think the time to buy (gold and silver) is ideal. Gold is the ultimate and only real money. Gold is the only safe asset when push comes to shove. They tell you to buy the government bond, that’s a safe asset. It’s not a safe asset at its current price. I am not saying the federal government is going to default in the next two or three years. I am saying the yield on a 10-year bond of 2.4% is way below of where it’s going to end up. So, the only safe asset left is gold.

This crazy Bitcoin mania has drained off what would otherwise be a demand for gold….When Bitcoin collapses, spectacularly, which it will because it’s sheer mania in the markets right now. When it collapses, I think a lot of that demand will come back into gold, as well as people fleeing the standard stock and bond markets for the first time in 9 or 10 years.”

Interest Rates

What could create a reversal in the equity madness? The first thing that should always come to mind are interest rate changes – higher interest rates to be specific. On that score, David Stockman said the following…

“The central banks realize they cannot keep printing money at these crazy rates, and by that I mean the bond buying. Now, they are going to begin to normalize and shrink their balance sheet…

By the fall (of 2018), they (the Federal Reserve) will be shrinking their balance sheet by $600 billion a year. What that means in plain simple English is that they (the Fed) are dumping $600 billion a year of existing bonds into the market just as Uncle Sam will be attempting to borrow $1.25 trillion more. Now, if you don’t think that is a financial collision waiting to happen, then I am not sure what would be.

We are heading for a thundering collision in the bond market that will drive yields upward far more than the market is expecting. The stock market operates on the illusion of permanently low interest rates. When interest rates start to rise, everything is going to come apart because cheap debt has been priced in forever, and we are heading for far more expensive debt…

Bond prices are going to collapse when yields begin to rise…

Stock prices are going to collapse big-time when the underlying predicate of cheap debt, massive stock buy backs and M&A deals and everything else supporting the market today finally reverses.”

Before this happens, shouldn’t you invest in gold now? Shouldn’t you buy gold for your IRA now? Timing is everything, and you should buy to prepare for the above mentioned problems.