High Volatility

The two most talked about markets at the company water cooler and family parties have been highly volatile over the last few weeks. The US stock market and Bitcoin have been extremely turbulent to the detriment of investors.

Friday saw a large drop across all of the major indices. The Dow fell -666 points, -2.54%. The S&P500 fell -66 points, -2.31%. The Nasdaq fell -145 points, -2.11%. All of these indices had fallen the previous several days, but the losses on Friday were a shock to current investors.

These declines sure hurt the wallets of the world’s richest people. Forbes reported: The fortunes of the world’s 500-richest people dropped by $73.9 billion Friday as equity markets swooned with investor worries about the pace of interest rate hikes in the U.S. Warren Buffett led the declines, shedding $3.3 billion to end the day at No. 3 on the Bloomberg Billionaire Index with $90.1 billion.

In fact, clients of Goldman Sachs are already nervously asking if it is 1987 all over again.

Despite market volatility this week, the S&P 500 has risen by 3% YTD. The 3.9% decline from last Friday’s close eclipses the 2.8% max drawdown of 2017. Nonetheless, 2018 ranks as just one of 13 years since 1950 to start with a January return greater than 5%. The volatile start of 2018 surprised many investors and caused clients to ask if they should [A] raise their return expectations for the full year, or [B] expect a sharp correction. In particular, investors ask about the likelihood of a repeat of 1987, when a 13% January return and additional 20% rise through August were destroyed on Black Monday, Oct. 19, when the index fell by 20%. The full-year return was 2%.

The other market that has been highly volatile over the last few days, and weeks, is Bitcoin. The decline in Bitcoin, however, is far worse than the US stock market.

On the CME exchange, Bitcoin futures traded as high as $20,650 on December 18th, 2017. Last Friday it traded as low as $7,750, which is a 62.5% drop. Since a mere 20% decline is the definition of a bear market, it’s understandable that people are upset. In fact, a 62.5% drop in just two months could be considered a crash. It may rebound some time, but the question is, when?

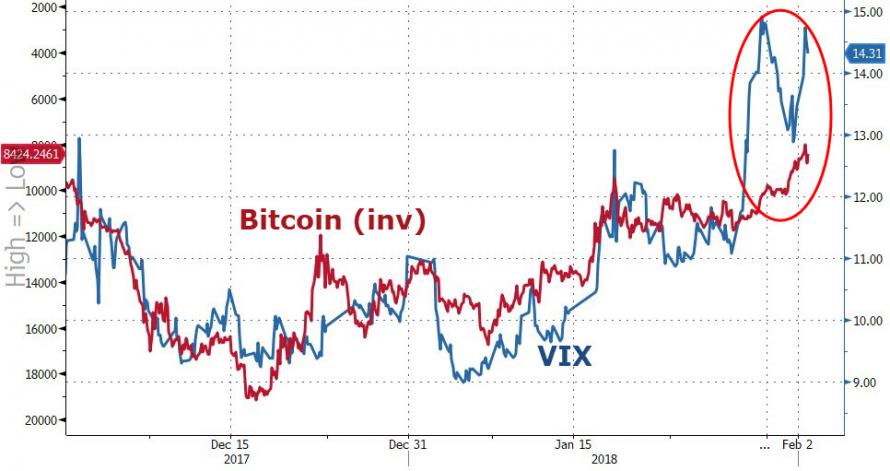

Deutsche Bank (DB), for one, believes that Bitcoin will be going lower. DB believes that the extremely low volatility prior to this past week is responsible for Bitcoin’s prior meteoric rise. With interest rates, spreads, and volatility (VIX) so low, DB believes that this essentially forced investors to look for other investments that could lead to good capital gains – like Bitcoin. But that has just changed as volatility defined by the VIX index has spiked. And since the vol is back and increasing, DB believes that will lead to further declines in Bitcoin prices.

Deutsche Bank sent the following note to its clients:

First, implied volatility. Implied volatility is an index calculated from the price of a derivative product (options) of an underlying marketable security. However, we now have a “tail wagging the dog” situation where the price of the derivative product is feeding back into the price of the underling marketable security.

Next, cryptocurrencies. Cryptocurrencies are closely watched by retail investors, affecting their risk preferences for stocks and other risk assets. Although institutional investors recognize that stocks and other asset valuations may have entered bubble territory (US equities’ average P/E is around 20x), they cannot help but continue their risk-taking. Now, a growing number of institutional investors are watching cryptocurrencies as the frontier of risk-taking to evaluate the sustainability of asset prices. The result is that institutional investors, who are supposed to value assets using their sophisticated financial literacy, analysis, and information-gathering strengths, are actually seeking feedback about the market from cryptocurrency prices (which are mainly formed by retail investors).

With all of this increased volatility that is dragging markets lower; why would anyone invest in them for the long term now? Stocks are still at astronomically high prices and have only begun to decline. Bitcoin is expected to fall even further with the increase in volatility. Given the changing times, everyone should invest in something stable and long term – Gold. In fact, adding gold to your IRA is another great idea. Buy gold today to balance and protect the balance of your portfolio.