Debt and Deficits

Many in the financial media, and certainly in the legacy media, are worried that the recent financial actions in Washington DC will result in problems down the road. Tax cuts and higher spending are the culprits. If the promised growth does not materialize, then the US debt and deficits will be rising quickly.

In order to fund what Washington DC believes is a very short term lack of funds, it needs to increase its issuance. The more bonds that the Treasury sells, the more money it receives to fund deficits. But that is only half of the story, as Treasury notes, bonds, etc all have an inverse yield to the direction of the price. So if the Treasury sells a lot of bonds, the price will be falling and therefore the yield will be rising.

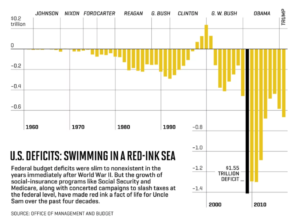

Look at the following chart from Fortune.com; do you see the rapidly rising deficits? This is only the beginning.

And that’s only a part of the issue. Remember when the Federal Reserve monetized all of the Treasury’s debt after the 2008 crash? Ah yes, good times. Well those good times are gone, because the Fed is now in tightening mode and is a net seller of the bonds that it bought during all of those years. So now, there are two big sellers of US debt: the Treasury, and the Federal Reserve.

Is there a third net seller on the horizon? If the current trade wars between the US and China escalate, China has warned that it will also be a massive seller of bonds, thus even higher rates.

The U.S. government’s huge and growing budget deficits have become gargantuan enough to threaten the great American growth machine. And Trump’s policies to date—a combination of deep tax cuts and sharp spending increases—are shortening the fuse on that fiscal time bomb, by dramatically widening the already unsustainable gap between revenues and outlays. On our current course, we’re headed for a morass of punitive taxes, puny growth, and stagnant incomes for workers—a future that’s the precise opposite of what Trump champions…

[The Doom Loop]

…as the debt load grows, efforts by the Federal Reserve to stimulate the economy with lower rates would be more likely to feed runaway inflation. “Then, investors will dump Treasuries,” says John Cochrane, an economist at the Hoover Institution. “That will drive rates far higher, and make the budget picture even worse.” – Fortune, March 15

So with all of this (and more) on the horizon, the “expected” growth had better come quickly. The benefits of the tax cuts will be felt very soon but the question is: Will corporations and individuals spend the extra money, or use it to pay down debt? I think it will be a little of both, but definitely won’t be all new spending.

So if the warnings above are correct, one should invest in GOLD to offset the ravages of higher interest rates and inflation. Whether one buys gold bullion or coins, adding gold to your IRA now, BEFORE interest rates climb, is the wise thing to do.