Why Gold Will Rally

As we write this blog post on Friday, February 9th, gold prices are roughly even on the day. The gold market has, however, come off its recent high of $1,365.40 of a few weeks ago. What caused this? Is it normal? Will the market rebound? Why isn’t gold rallying with all of the surrounding turmoil? These are all great questions, and there are surely more that we haven’t addressed, but let’s take a look at some answers.

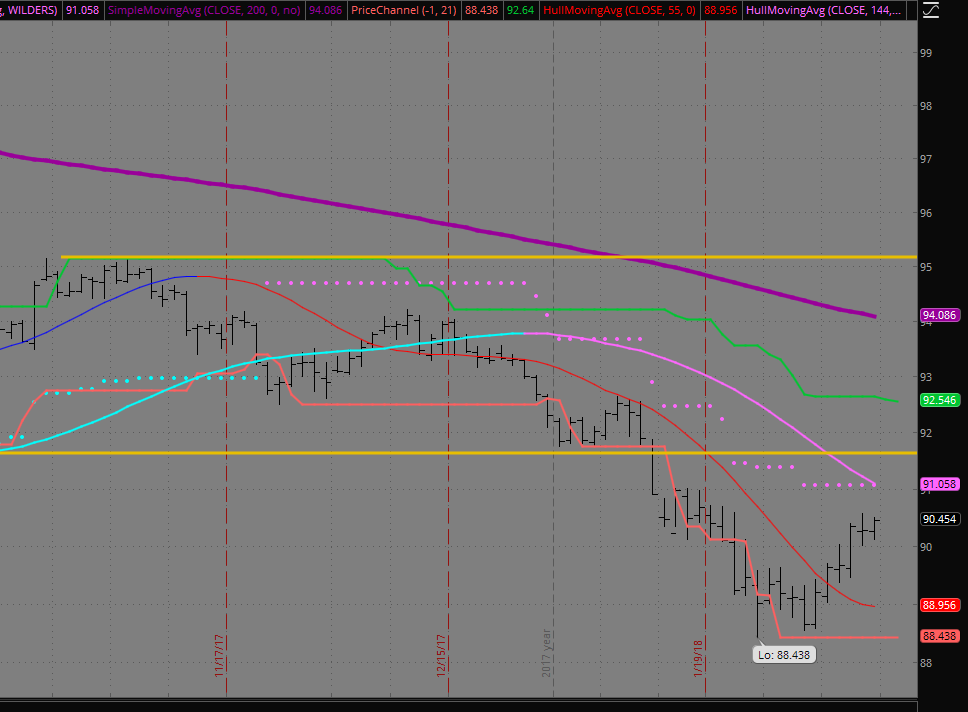

The recent declines for precious metals has partly been driven by a rally in the U.S. dollar, with the $DXY, a measure of greenback against a half-dozen rivals, rising about 1.5% for the week. As you can see in the chart below, there is a persistent bid in the US dollar, which would be its sharpest weekly gain since November 2016. How does this affect the price of gold? Foreign currencies are weaker relative to the US dollar, making them more expensive for those buying with the weaker monetary units.

What else can we see on the chart of the US dollar below? Although the most recent move is up, thus bad for gold, the overall trend is most certainly down. Of course, in the long run this is good for the price of gold.

There are other reasons for the recent weakness in gold, like margin calls. George Milling-Stanley, head of gold investment strategy at State Street Global Advisors, told MarketWatch that some of the recent selling in gold came as trades were forcibly unwound. “It was really about margin call selling. Investors sold some of their gold holdings to meet some of their margin calls on leveraged equities,” Milling-Stanley said. So the extreme volatility in the stock market created problems (margin calls) for those long the wrong markets. As they lost money, they had to sell profitable positions, like gold, to cover the losses in stocks.

Although we are not “trading” gold, it helps to look at the charts for explanations similar the dollar above. The gold chart below shows the very strong rally from the $1,240.00 level to $1,365.40. The latter price, the recent peak, was at the high of September 9th. Weakness there is normal. What else do we see? Gold is coming back to the recent highs of $1,310.00 to $1,300.00, which should offer great support. So based on the normal chart levels, buying gold here looks quite good.

What are some other reasons for another rally in gold? Bubbles! It was just a week ago when the prior Fed Chairman, Alan Greenspan, said the following: “There are two bubbles. We have a stock market bubble and a bond market bubble. At the end of the day, the bond bubble will be the big issue.” Mr. Greenspan couldn’t be more correct. It is the bond market bubble’s popping that is causing interest rates to raise, and equities to get draw-and-quartered. The rise in interest rates are also being caused by creeping fear of inflation. Perhaps the economy is set to overheat due to all of the global stimulus. Many believe this to be true – and this is also bullish for gold.

So if you have been waiting for a good entry, for a good time to add gold to your IRA, we believe that now is the time.